Home » Uninsured & Underinsured Motorist Claim Lawyer

Uninsured & Underinsured Motorist Claim Lawyer in Ohio

Getting into an accident is a traumatic and frustrating experience. This is made all the more challenging when the other driver is underinsured or has no insurance at all. Fortunately, legal options still exist, and you can still get justice if you are in this situation.

Legally Reviewed by:

Mark S. Gervelis, Esq.

Last Updated:

- November 21, 2025

- About 17.1 percent of Ohio motorists are uninsured, making uninsured motorist (UM) coverage crucial to protect against medical costs, lost wages, and property damage if an uninsured or hit-and-run driver hits you.

- Ohio mandates 25/50/25 liability coverage, which may not be enough in serious accidents, highlighting the value of underinsured motorist (UIM) coverage.

- Key actions after a crash include checking for injuries, calling 911, documenting the scene, collecting witness information, notifying your insurer, filing a claim, and consulting an attorney.

- Gervelis Law provides comprehensive support for underinsured and uninsured motorist coverage claims, including on-site investigations within 24 hours, assistance navigating insurance company tactics, and representation to maximize compensation.

- Insurance companies often underpay or deny valid claims. Gervelis Law’s experienced attorneys provide aggressive, localized legal representation to ensure clients receive the full compensation they are entitled to.

TABLE OF CONTENTS

Uninsured drivers do not have auto insurance coverage, while underinsured drivers may have some insurance but not enough to cover all the damages and injuries that resulted from the wreck.

Our compassionate legal team at Gervelis Law Firm can help with your case regardless of the circumstances. Contact our uninsured and underinsured motorist claim lawyers in Ohio today for a free consultation.

What Is Uninsured and Underinsured Motorist Coverage?

In Ohio, 17.1 percent of motorists are uninsured. Uninsured motorist coverage protects you if you are involved in a car accident where the at-fault driver has no insurance. It covers medical expenses, lost wages, and other damages.

Underinsured motorist coverage applies when the at-fault driver has insurance, but their coverage limits are insufficient to cover your total damages. This insurance steps in to cover the remaining costs.

In Ohio, if you are involved in a hit-and-run accident, uninsured motorist coverage is essential. With the at-fault driver being unknown, your uninsured motorist coverage policy can help pay for medical costs and property damage.

Ohio’s Motorist Insurance Requirements

As of 2025, Ohio requires minimum auto liability insurance coverage limits known as 25/50/25, which is:

- $25,000 for bodily injury liability per person

- $50,000 for bodily injury liability per accident

- $25,000 for property damage liability per accident

However, these limits often fall short in cases involving serious injuries. You may be facing severe damages that go beyond these numbers, such as extensive ongoing medical bills and time off work. Underinsured and uninsured motorist coverage can protect victims beyond the at-fault driver’s limits.

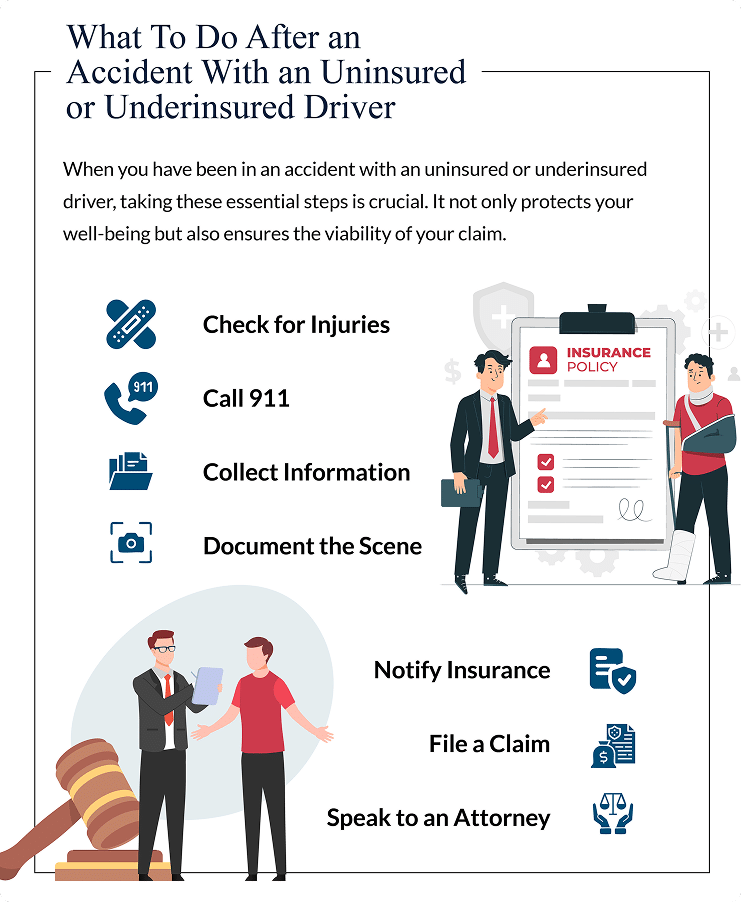

What To Do After an Accident With an Uninsured or Underinsured Driver

When you have been in an accident with an uninsured or underinsured driver, taking these essential steps is crucial. It not only protects your well-being but also ensures the viability of your claim.

Check for Injuries

The most crucial step following an accident is ensuring everyone is safe. Check for injuries and contact emergency services if needed. You should also move out of the way of flowing traffic.

Call 911

Contact the police to file a report. They will collect vital information from the accident that can be used when determining fault. You will want to obtain a copy of the police report as well.

Collect Information

Exchange contact information with the other drivers and any witnesses. Avoid discussing the accident with anyone besides an attorney.

Document the Scene

Take photos of the scene, including your injuries, damage to vehicles, and road conditions.

Notify Insurance

Get in touch with your insurance company to report the incident and inform them whether the other driver is uninsured or underinsured.

File a Claim

If you have uninsured or underinsured motorist coverage, your insurer can cover medical bills, lost wages, and possibly property damage. In hit-and-run cases, underinsured motorist coverage may also apply if the at-fault driver cannot be identified.

Speak to an Attorney

Our attorneys at Gervelis Law are here to support you. We will handle the bulk of your case, allowing you to focus on recovery. Our Rapid Investigation Team will be on-site within 24 hours to gather evidence to support your claim, providing you with the care and attention you need.

Why You Need a Lawyer for a UM/UIM Claim in Ohio

Insurance companies often underpay, delay, or deny legitimate claims. Without the proper advocacy, you could face a payout that is less than you need for your losses. However, fighting back against insurers on your own is challenging, especially when it comes to proving damages and triggering uninsured and uninsured motorist coverage policies.

Early legal intervention is crucial in uninsured and underinsured motorist claims. Gervelis Law Firm is your one-stop shop for all legal matters involving these coverages. Our team can provide essential support with your case from start to finish. We can work to maximize your compensation in a claim and get you the recovery you deserve. Call today to speak with our Ohio uninsured motorist coverage attorneys.

How Gervelis Law Firm Fights for You

At Gervelis Law, we have decades of experience fighting for justice. With a local presence in communities like Toledo, Columbus, and beyond, you can trust that we can effectively navigate the legal landscape of your case.

We are uniquely positioned to provide aggressive, experienced, and effective legal representation. We will always keep you informed every step of the way—that is the Gervelis Guarantee. Our attorneys are members of the Ohio Association for Justice Advocates Circle, and our case results speak for themselves:

- $130,000 recovered for a car accident where the defendant crossed the center line and struck our client’s vehicle.

- $140,000 recovered for a car accident where our client’s vehicle was rear-ended twice by separate drivers.

No matter your circumstances, we stay accessible to you. We will meet with clients at their homes, at the hospital, or at a location that is most convenient for them. For more information and to get started on building a case, reach out to our law office today.

Call to Action: Get Legal Help You Can Count On

Do not hesitate to get the help you need. Our team has been part of your community for decades and will ensure that you do not go through this difficult time alone. Contact Gervelis Law Firm today for a free consultation and take the first step towards getting the justice you deserve.

AVAILABLE 24/7

FREE CASE EVALUATION

"*" indicates required fields

CASE RESULTS

Medical Malpractice

$75,000,000

-Canfield/Youngstown-

Motorcycle Accident

$3,499,000

-Akron & Ashtabula-

Fall Accident

$850,000

-Canfield/Youngstown-

Truck Accident

$900,000

-Toledo-

CLIENT TESTIMONIALS

Gervelis Law Firm – here for you when you need us most.

Your best interests always come first at Gervelis Law Firm. Contact us and find out how we can help you.