For more than thirty years, federal regulations have set minimum liability insurance coverage for trucks at $750,000. This figure has not changed since 1983. It has not even been adjusted for inflation. The Federal Motor Carrier Safety Administration recently declined yet another proposal to raise the minimum coverage standard. Now, more than ever, it is critical that victims have an experienced Akron truck accident attorney representing them to ensure they receive full and fair compensation for their injuries.

For more than thirty years, federal regulations have set minimum liability insurance coverage for trucks at $750,000. This figure has not changed since 1983. It has not even been adjusted for inflation. The Federal Motor Carrier Safety Administration recently declined yet another proposal to raise the minimum coverage standard. Now, more than ever, it is critical that victims have an experienced Akron truck accident attorney representing them to ensure they receive full and fair compensation for their injuries.

How Coverage Minimums Protect the Trucking Industry

It is no secret that the trucking industry has powerful lobbyists in Washington. When conflicts arise between safety and financial interests, these lobbyists encourage laws that protect the trucking industry's financial interest. Oddly, even the trucking industry seems to recognize that $750,000 is not a sufficient amount of coverage to pay for the severe injuries caused by trucks and big rigs. Fair Warning reports that the Trucking Alliance encourages its members to maintain "significantly higher" coverage than the federal minimum. Trucking companies are subject to judgments against them for any legal judgments not covered by liability insurance, but such judgments are very rarely paid.

It is also important to note that, while the cost of medical care has spiked dramatically since 1983, the amount of coverage available to pay for truck accident injuries has not. Fair Warning estimates that the same amount of coverage, adjusted for inflation, would equate to $2.2 million in 2017. But the minimum continues to defy inflation - let alone the exponential costs of American health care. It has become increasingly difficult to find anyone who benefits from the stagnant minimum liability coverage.

How Injury Victims are Harmed By Stagnant Insurance Coverage

Of course, it is injury victims who pay the greatest price. When a truck driver negligently causes an accident that injures another person, the injury victim has a legal claim against the truck driver. Often, the victim has a claim against the trucking company that employed the driver. He or she can file a claim with the driver's (or trucking company's) insurance carrier to be compensated for medical bills and other financial losses caused by the accident, such as lost wages. If the insurance company denies the claim or makes an inadequate settlement offer, the victim can sue the driver or trucking company.

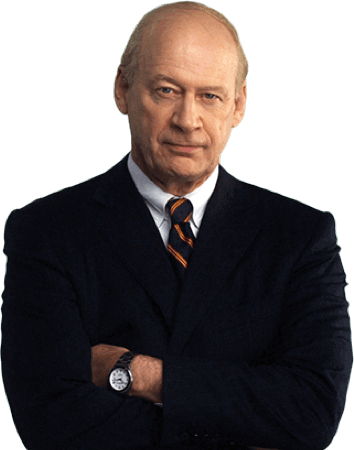

But what happens when a trucking company does not have sufficient coverage? This is a frequent problem for victims who are seriously injured or killed in trucking accident. Fair Warning reports on one such tragic case out of Ohio. Ed Slattery lost his wife, Susan, in a big rig accident on the Ohio Turnpike in 2010. His two young sons, who were also in the car, were critically injured. Slattery notes that $750,000 wouldn't have paid for his sons' initial hospital bills - let alone their future medical care, or the wrongful death of his wife. In such a situation, the family members left behind often have no choice but to settle for the company's policy limits. They are then left to foot the bill for medical expenses caused by the negligence of someone else.